Accrual to Cash Conversion Excel Worksheet

The expense cash payments are given by the following accrual to cash conversion formula. This example shows how receivables, payables, prepaid expenses, and unearned revenue all adjust your actual cash position. We help that this article helped you in unearned revenue your process of understanding accrual to cash conversions. For more articles like this be sure to check out our dedicated accounting and Chartered Financial Analyst (CFA) pages. In the new period, an accruals basis profits figure must becalculated, and this will include only income from work done in that period,whether or not a customer has paid.

Cash Method vs Accrual Method

For instance, separating fixed and variable expenses can help in better cash flow management. This account records all payments made by the business, including expenses, debt payments, and purchases. It tracks all money going out of the business, ensuring it is only recognized when the payment is made. Regulatory requirements do affect this decision and small businesses that want to convert to a cash basis method must file form 3115.

Accounts payable

- The shorter the cash conversion cycle, the better, as it means that the company is generating cash more quickly.

- You would record the $200 of income on July 15 when you collected the cash—not in June when you performed the service.

- Effective communication and collaboration are also essential for long-term success.

- Accrual to cash adjustments is a critical process for businesses transitioning from accrual-based accounting to cash-based accounting.

In the context of the accounting cycle, adjusting entries are a critical step that comes after a trial balance but before the preparation of financial statements. They are essential for ensuring that the trial balance accurately reflects all financial activities. Adjusting entries are necessary to adhere to the accrual concept, where transactions are recorded when they occur, not necessarily when cash changes hands. This practice ensures that financial statements are a true representation of a company's financial status. This article examines the reasons why small businesses would make a switch to accrual basis to cash and how to record financial transactions when making a cash basis adjustment. As show above, there is no accounts payable nor accounts receivables on the books and retained earnings ties from one year to the next.

Understanding Goodwill in Balance Sheet – Explained

Taxes are incredibly complex, so we may not have been able accrual to cash adjustment to answer your question in the article. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have. You can connect with a licensed CPA or EA who can file your business tax returns. Free up time in your firm all year by contracting monthly bookkeeping tasks to our platform.

Convert Accrual to Cash Basis Worksheet: A Complete Guide for Businesses

Then, the amount is amortized throughout the year, recognizing 1/12 of it when earned each month, reducing the liability figure, and recording the related expenses. That way, the liability is seen instead of that cash in January – making it easier to know if the organization is profitable and allowing for wiser business decisions. Accounting software - accounting software is an essential tool for any business looking to convert from accrual to cash accounting.

- Just like we mentioned above, usually accrual accounting is praised for its accuracy.

- With accrual accounting, you get the following business performance-enhancing benefits and more.

- Conversely, businesses with substantial accounts payable may benefit from an immediate deduction of these expenses, potentially lowering their tax liability.

- TDRs can involve adjustments like interest rate reductions, extended payment plans, or even principal forgiveness.

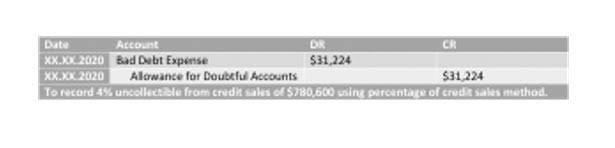

- This accrual to cash conversion excel worksheet can be used to convert revenue, expenses, purchases, and cost of goods sold found in accrual based financial statements to cash receipts and payments information.

- In that case, I strongly recommend you switch to accrual accounting and learn how to use the resultant data to guide your decisions.

Under the cash basis method, income is only recognized when it is received, and expenses are deducted when they are paid. This can lead to a deferral of income and acceleration of expenses, potentially reducing taxable income in Car Dealership Accounting the short term. Accrual accounting is a widely used accounting method that records financial transactions when they occur, regardless of whether cash has been exchanged. This method is used by businesses to provide a comprehensive picture of their financial performance over a given period.

উপদেষ্টা সম্পাদকঃ মোঃ মিজানুর রহমান। সম্পাদকঃ আবু সালে শিমুল মোবাইলঃ ০১৯৩৯৬৬০৭৮২ প্রকাশকঃ খলিলুর রহমান সুমন। বার্তা সম্পাদকঃ কাজী রায়হান সুলতান। হাউজ নং এন আই -৮০, হাউজিং এস্টেট, রোড নং ২২৮, পৌর সুপার কিচেন মার্কেট, মেইনগেট সংলগ্ন, জিপিও ৯০০০, খালিশপুর, খুলনা।